capital gains tax changes 2021 uk

The change will have effect on and after 6 April 2021. Relief for gifts of business assets.

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

Changes to Capital Gains Tax UK 2021 how theyll affect you.

. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. 2020 to 2021 2019 to 2020 2018 to 2019. This could result in a significant increase in CGT rates if this recommendation is implemented.

In this property education video Simon Zutshi author of Property Magic founder of the property investors network pin and successful property investor since 1995 shares his thoughts on. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Non-resident Capital Gains Tax on the disposal of a UK residential property.

This is called entrepreneurs relief. Figures from the Treasury released in August show that its Capital Gains Tax. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020.

The changes in tax rates could be as follows. Its the gain you make thats taxed not the. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. The same change will also apply for non-UK residents disposing of property. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

For example CGT is applied at a higher rate for property than other. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for. Capital Gains Tax UK changes are coming.

Add this to your taxable. This time last year an. If you own a property with a.

5 days ago Dec 09 2020 Capital Gains Tax UK changes are coming. So for the first 12300 of capital gain you could take that money completely tax-free. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Proposed changes to Capital Gains Tax. For the 2021 to 2022 tax year the allowance is. Capital Gains Tax UK changes are coming.

HM Revenue and Customs is expected to collect 69billion in Inheritance Tax in 2023 to 2024 with some of this due to gifts gone wrongHowever careful planning could make all the. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget. CGT is a complex tax and this is one of the reasons it is seen as a good candidate for sweeping reforms.

First deduct the Capital Gains tax-free allowance from your taxable gain. Each year at the moment there is a personal capital gains tax allowance. Attend your first virtual pin meeting for FREE using the code YouTube just click on the link belowhttpspropertyinvestorsnetworkcoukmeetingsIn this.

If capital gains tax rates are not aligned. 118 Capital Gains Tax. A recent report from the UK Office of Tax Simplification.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. With equivalent bodies providing state-funded housing.

What you pay it on rates and allowances 1 week ago First deduct the Capital Gains tax-free allowance from your taxable gain. Annual exemption and rates of tax. You can change your cookie settings at any time.

Any gain over that amount is taxed at what.

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Will Capital Gains Tax Increase At Budget 2021 What The Property Tax Rate Is And How It Could Change Today

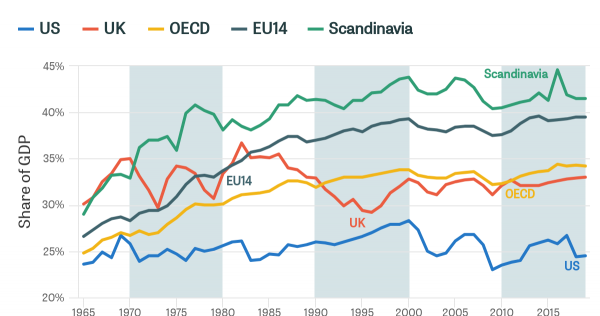

How Do Uk Tax Revenues Compare Internationally Institute For Fiscal Studies

Budget 2021 Highlights And Key Changes Evelyn Partners

5 Important Tax Changes For 2021

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Review 2 Things That Could Change Pembroke Financial

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Capital Gains Tax When Selling A Home Homeowners Alliance

How Much Is Capital Gains Tax On Property Legend Financial

Larking Gowen On Twitter Phew No Change To Capital Gains Tax Rules For Business Sellers For Now At Least Could Now Be The Time To Implement Your Succession Plans Before Rishi Takes

What You Need To Know About Capital Gains Tax

Capital Gains Tax Changes In 2021 What Do Uk Investors Need To Know Youtube

Capital Gains Tax Challenges In 2021 Effect On Property Investors Property Investors With Samuel Leeds

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)